EUROPEAN COMMISSION

EUROPEAN COMMISSION

Brussels, 3.9.2020

COM(2020) 474 final

COMMUNICATION FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT, THE COUNCIL, THE EUROPEAN ECONOMIC AND SOCIAL COMMITTEE AND THE COMMITTEE OF THE REGIONS

Critical Raw Materials Resilience: Charting a Path towards greater Security and Sustainability

1.Introduction

Metals, minerals and natural materials are part of our daily lives. Those raw materials that are most important economically and have a high supply risk are called critical raw materials. Critical raw materials are essential to the functioning and integrity of a wide range of industrial ecosystems. Tungsten makes phones vibrate. Gallium and indium are part of light-emitting diode (LED) technology in lamps. Semiconductors need silicon metal. Hydrogen fuel cells and electrolysers need platinum group metals.

Access to resources is a strategic security question for Europe’s ambition to deliver the Green Deal

. The new industrial strategy for Europe

proposes to reinforce Europe’s open strategic autonomy, warning that Europe’s transition to climate neutrality could replace today’s reliance on fossil fuels with one on raw materials, many of which we source from abroad and for which global competition is becoming more fierce. The EU’s open strategic autonomy in these sectors will therefore need to continue to be anchored in diversified and undistorted access to global markets for raw materials

. At the same time, and in order to decrease external dependencies and environmental pressures, the underlying problem of rapidly increasing global resources demand needs to be addressed by reducing and reusing materials before recycling them.

The enormous appetite for resources (energy, food and raw materials) is putting extreme pressure on the planet, accounting for half of greenhouse gas emissions and more than 90% of biodiversity loss and water stress. Scaling up the circular economy will be vital to achieve climate neutrality by 2050, while decoupling economic growth from resource use and keeping resource use within planetary boundaries

.

Access to resources and sustainability is key for the EU’s resilience in relation to raw materials. Achieving resource security requires action to diversify supply from both primary and secondary sources, reduce dependencies and improve resource efficiency and circularity, including sustainable product design. This is true for all raw materials, including base metals, industrial minerals, aggregates and biotic materials, but is even more necessary when it concerns those raw materials that are critical for the EU.

As if this challenge was not enough, the COVID-19 crisis has revealed just how fast and how deeply global supply chains can be disrupted. The Commission has proposed an ambitious COVID-19 recovery plan

to increase resilience and open strategic autonomy and to foster the transition towards a green and digital economy. With its aim of ensuring resilience through a secure and sustainable supply of critical raw materials, this Communication can make a major contribution to the recovery and the long-term transformation of the economy.

Building on the EU’s Raw Materials Initiative

, this Communication presents:

-the EU 2020 list of critical raw materials

-the challenges for a secure and sustainable supply of critical raw materials and actions to increase EU resilience and open strategic autonomy.

1. The 2020 EU Critical Raw Materials List

The Commission reviews the list of critical raw materials for the EU every three years. It published the first list in 2011, updating it in 2014 and 2017

. The assessment is based on data from the recent past and shows how criticality has evolved since the first list was published. It does not forecast future trends. This is why the Commission is also presenting a foresight study (see below).

The 2020 assessment follows the same methodology as in 2017

. It uses the average for the most recent complete 5-year period for the EU without the United Kingdom (EU-27). It screened 83 materials (5 more than in 2017) and, where possible, looked more closely than previous assessments at where criticality appears in the value chain: extraction and/or processing.

Economic importance and supply risk are the two main parameters used to determine criticality for the EU. Economic importance looks in detail at the allocation of raw materials to end-uses based on industrial applications. Supply risk looks at the country-level concentration of global production of primary raw materials and sourcing to the EU, the governance of supplier countries

, including environmental aspects, the contribution of recycling (i.e. secondary raw materials), substitution, EU import reliance and trade restrictions in third countries.

The resulting list of critical raw materials provides a factual tool to support EU policy development. The Commission takes the list into consideration when negotiating trade agreements or seeking to eliminate trade distortions. The list helps to identify investment needs, and to guide research and innovation under the EU’s Horizon 2020, Horizon Europe and national programmes, especially on new mining technologies, substitution and recycling. It is also relevant for the circular economy

, to promote sustainable and responsible sourcing, and for industrial policy. Member States and companies can also use it as an EU reference framework for developing their own specific criticality assessments.

The 2020 EU list contains 30 materials as compared to 14 materials in 2011, 20 materials in 2014 and 27 materials in 2017. 26 materials stay on the list. Bauxite, lithium, titanium and strontium are added to the list for the first time. Helium remains a concern as far as supply concentration is concerned, but is removed from the 2020 critical list due to a decline in its economic importance. The Commission will continue to monitor helium closely, in view of its relevance for a range of emerging digital applications. It will also monitor nickel closely, in view of developments relating to growth in demand for battery raw materials.

|

2020 Critical Raw Materials (new as compared to 2017 in bold)

|

|

Antimony

|

Hafnium

|

Phosphorus

|

|

Baryte

|

Heavy Rare Earth Elements

|

Scandium

|

|

Beryllium

|

Light Rare Earth Elements

|

Silicon metal

|

|

Bismuth

|

Indium

|

Tantalum

|

|

Borate

|

Magnesium

|

Tungsten

|

|

Cobalt

|

Natural Graphite

|

Vanadium

|

|

Coking Coal

|

Natural Rubber

|

Bauxite

|

|

Fluorspar

|

Niobium

|

Lithium

|

|

Gallium

|

Platinum Group Metals

|

Titanium

|

|

Germanium

|

Phosphate rock

|

Strontium

|

More details on the materials are available in Annex 1, the report on the assessment and the factsheet accompanying each material, published on the EU Raw Materials Information System

.

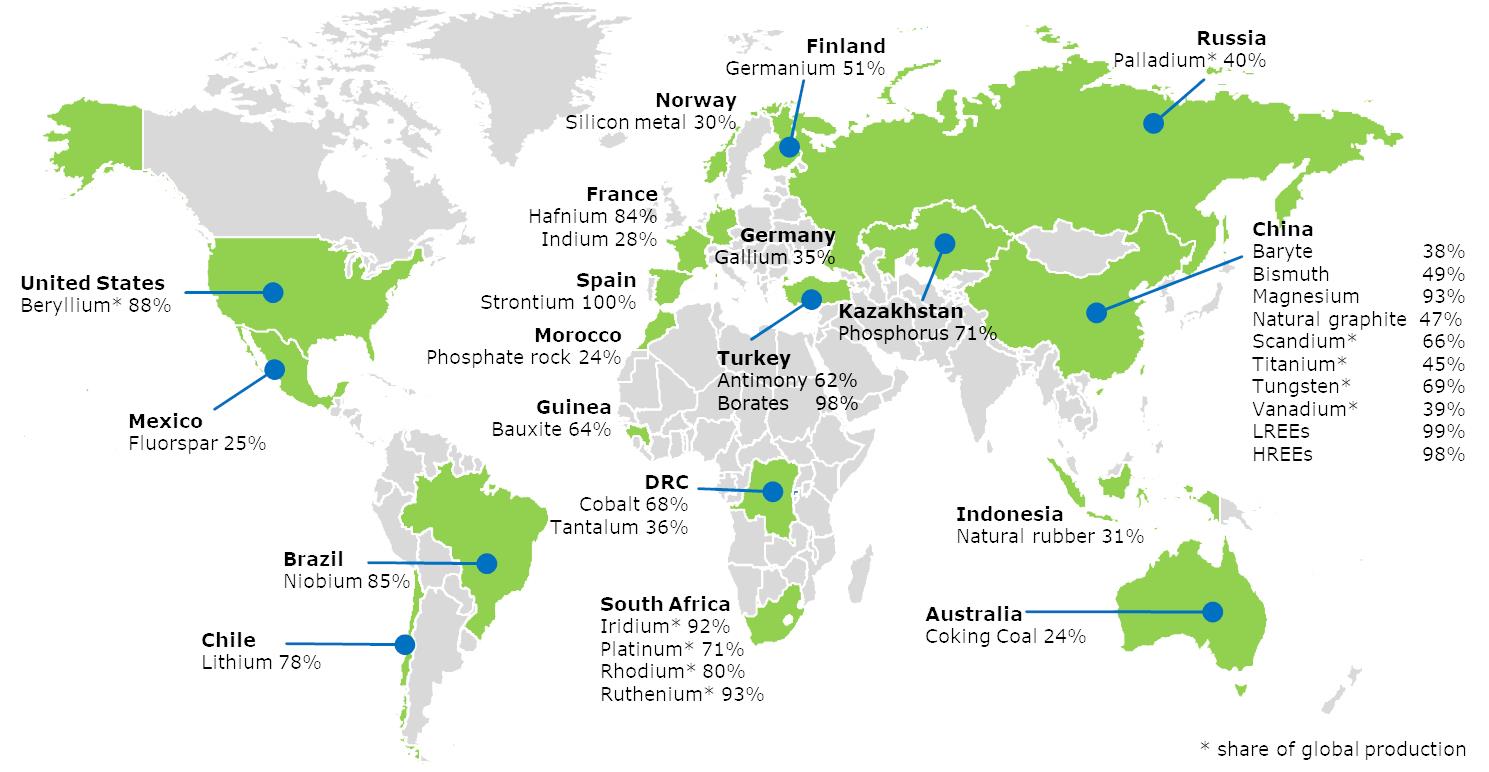

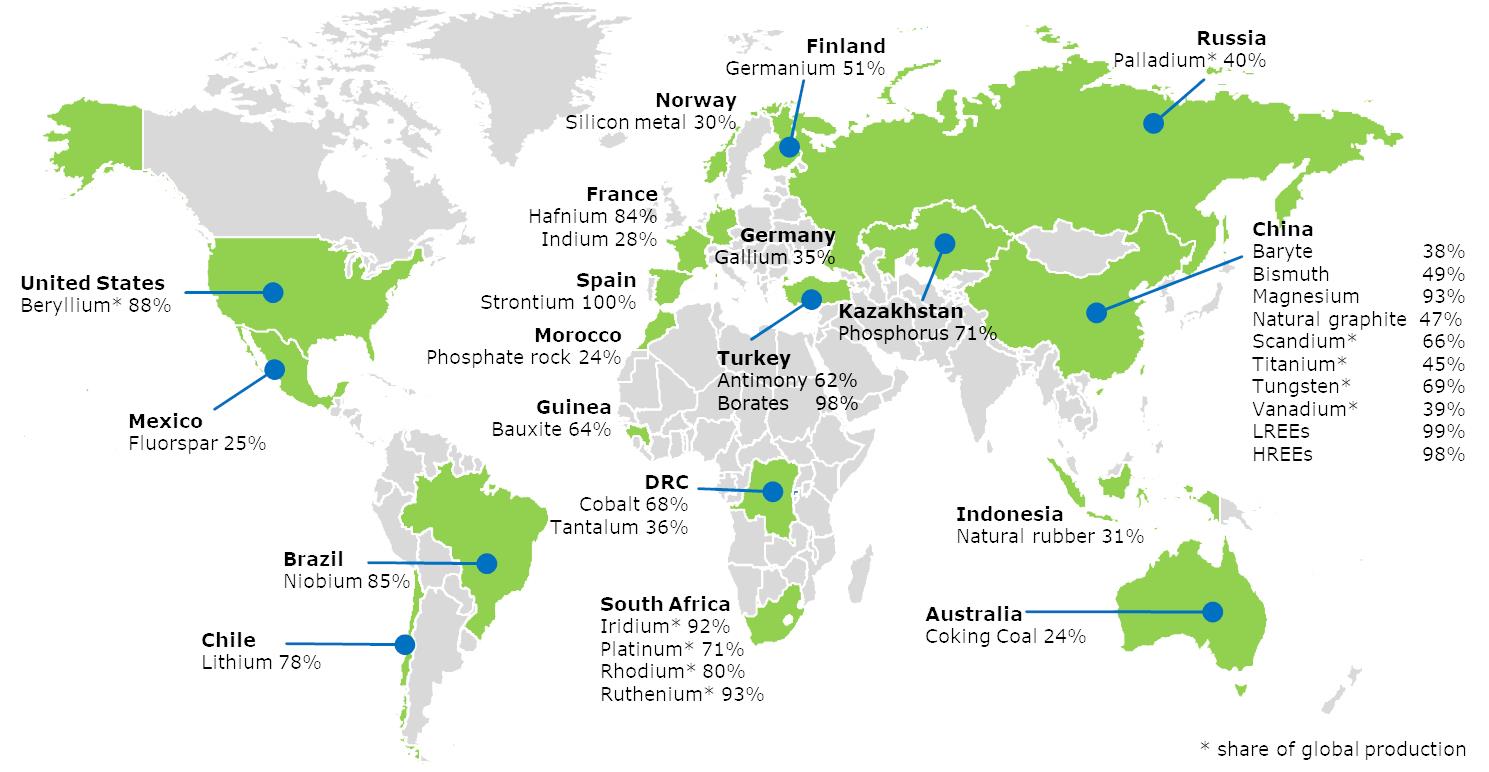

The supply of many critical raw materials is highly concentrated. For example, China provides 98 % of the EU’s supply of rare earth elements (REE), Turkey provides 98% of the EU’s supply of borate, and South Africa provides 71% of the EU’s needs for platinum and an even higher share of the platinum group metals iridium, rhodium, and ruthenium. The EU relies on single EU companies for its supply of hafnium and strontium.

Figure 1: biggest supplier countries of CRMs to the EU

Source: European Commission report on the 2020 criticality assessment

2.Enhancing the EU’s Resilience : the Supply and Sustainability Challenge

Knowledge and intelligence are preconditions for informed decision-making. The Commission already developed the Raw Materials Information System and will reinforce it, but more is needed. To this end, the Commission will strengthen its work with Strategic Foresight Networks to develop robust evidence and scenario planning on raw materials supply, demand and use for strategic sectors. The criticality assessment methodology may be reviewed for the next list (2023) to integrate the latest knowledge.

The EU will contribute to global efforts towards better resource management in co-operation with relevant international organisations.

This knowledge base should enable strategic planning and foresight, reflecting the EU’s objective of a digital and climate-neutral economy by 2050 and enhance its leverage on the world stage. The geopolitical aspect should also play an integral part in foresight, enabling Europe to anticipate and address future needs.

Based on the information that is currently available, the foresight report

published with this Communication, complements the criticality assessment based on recent data, by providing the critical raw materials outlook to 2030 and 2050 for strategic technologies and sectors. It translates the EU’s (pre COVID-19) climate-neutrality scenarios for 2050

into the estimated demand for raw materials and addresses supply risks at different levels of the supply chains:

·For electric vehicle batteries and energy storage, the EU would need up to 18 times more lithium and 5 times more cobalt in 2030, and almost 60 times more lithium and 15 times more cobalt in 2050, compared to the current supply to the whole EU economy. If not addressed, this increase in demand may lead to supply issues

.

·Demand for rare earths used in permanent magnets

, e.g. for electric vehicles, digital technologies or wind generators, could increase tenfold by 2050.

This should be seen in the global context of growing demand for raw materials due to population growth, industrialisation, decarbonisation of transport, energy systems and other industrial sectors, increasing demand from developing countries and new technological applications.

The World Bank projects that demand for metals and minerals increases rapidly with climate ambition

. The most significant example of this is electric storage batteries, where the rise in demand for relevant metals, aluminium, cobalt, iron, lead, lithium, manganese and nickel would grow by more than 1000 per cent by 2050 under a 2°C scenario compared to a business as usual scenario.

The OECD forecasts that, despite improvements in materials intensity and resource efficiency and the growth in the share of services in the economy, global material use will more than double from 79 billion tons in 2011 to 167 billion tons in 2060 (+110%).

This is an overall figure, which includes relatively abundant and geographically spread resources such as construction materials and wood. For criticality purposes, it is worth looking more closely at the OECD’s forecast for metals, projected to increase from 8 to 20 billion tonnes in 2060 (+150%)

. The EU is between 75% and 100% reliant on imports for most metals

.

The OECD concludes that the growth in materials use, coupled with the environmental consequences of material extraction, processing and waste, is likely to increase the pressure on the resource bases of the planet’s economies and jeopardize gains in well-being. Without addressing the resource implications of low-carbon technologies, there is a risk that shifting the burden of curbing emissions to other parts of the economic chain may simply cause new environmental and social problems, such as heavy metal pollution, habitat destruction, or resource depletion

.

The COVID-19 crisis is leading many parts of the world to look critically at how they organise their supply chains, especially where the sources of supply for raw materials and intermediate products are highly concentrated and, therefore, at higher risk of supply disruption. Improving the resilience of critical supply chains is also vital to ensure both the clean energy transition and energy security

.

In its proposal for the European recovery plan, the Commission sees critical raw materials as one of the areas where Europe needs to be more resilient in preparation for future shocks and to have more open strategic autonomy. This can be achieved by diversifying and strengthening global supply chains including by continuing to work with partners around the world, reducing excessive import dependence, enhancing circularity and resource efficiency, and, in strategic areas, by increasing supply capacity within the EU.

3.Turning Challenges into opportunities

China, the United States, Japan and others are already working fast to secure future supplies, diversify sources of supply through partnerships with resource-rich countries and develop their internal raw material-based value chains.

The EU should act urgently to ensure a secure, sustainable supply of raw materials, pooling the efforts of companies, sub-national and national authorities as well as the EU institutions.

The EU action plan for critical raw materials should:

-Develop resilient value chains for EU industrial ecosystems;

-reduce dependency on primary critical raw materials through circular use of resources, sustainable products and innovation;

-strengthen the sustainable and responsible domestic sourcing and processing of raw materials in the European Union, and

-diversify supply with sustainable and responsible sourcing from third countries, strengthening rules-based open trade in raw materials and removing distortions to international trade.

The Commission intends to develop and implement these priority objectives and the action plan with the help of Member States and stakeholders, in particular the European Innovation Partnership on Raw Materials and the Raw Materials Supply Group. It will also draw on the support and expertise of the European Institute of Innovation and Technology (EIT) Raw Materials.

3.1.Resilient value chains for EU industrial ecosystems

Gaps in EU capacity for extraction, processing, recycling, refining and separation capacities (e.g. for lithium or rare earths) reflect a lack of resilience and a high dependency on supply from other parts of the world. Certain materials mined in Europe (like lithium) currently have to leave Europe for processing. The technologies, capabilities and skills in refining and metallurgy are a crucial link in the value chain.

These gaps, and vulnerabilities in existing raw materials supply chains, affect all industrial ecosystems and therefore require a more strategic approach: adequate inventories to prevent unexpected disruption to manufacturing processes; alternative sources of supply in case of disruption, closer partnerships between critical raw material actors and downstream user sectors, attracting investment to strategic developments.

Through the European Battery Alliance, public and private investment has been mobilised at scale and should, for example, lead to 80% of Europe’s lithium demand being supplied from European sources by 2025.

The new industrial strategy proposes to develop new industrial alliances. The raw materials dimension should be an integral part of these alliances and of the corresponding industrial ecosystems (as preliminarily identified in the Staff Working Document accompanying the Recovery Plan

- see Annex 2). However, there is also a need for a dedicated industrial alliance on raw materials, as announced in the industrial strategy, since there are a number of important challenges such as highly concentrated global markets, technical barriers to investment and to innovation, public acceptance and the need to raise level of sustainable sourcing.

In a first phase, this European Raw Materials Alliance will focus on the most pressing needs, which is to increase EU resilience in the rare earths and magnets value chain, as this is vital to most EU industrial ecosystems (including renewable energy, defence and space). The alliance can expand to address other critical raw material and base metal needs over time. The work of the alliance will be complementary to external actions to secure access to these critical materials.

The alliance will be open to all relevant stakeholders, including industrial actors along the value chain, Member States and regions, trade unions, civil society, research and technology organisations, investors and NGOs. The alliance will be built on the principles of openness, transparency, diversity and inclusiveness. It will respect EU competition rules and EU international trade commitments. The alliance will identify barriers, opportunities and investment cases and will have an agile governance framework involving all relevant stakeholders and allowing project-based work to be carried out.

The European Investment Bank has recently adopted its new energy lending policy, in which it states that the bank will support projects relating to the supply of critical raw materials needed for low-carbon technologies in the EU. This is important to help de-risk projects and attract private investment in the EU and in those resource-rich third countries within its operating mandate. At the same time it must be ensured that such projects are free from distortions and contribute to the EU’s open strategic autonomy and resilience in a resource-efficient and sustainable manner.

The EU sustainable finance taxonomy will guide public and private investments towards sustainable activities. It will address the enabling potential of the mining and extractive value chain and the need for the sector to minimise its impacts on the climate and environment, taking into account life cycle considerations

. This should help to mobilise support for compliant exploration, mining and processing projects for critical raw materials in a sustainable and responsible way.

|

Action 1 – Launch an industry-driven European Raw Materials Alliance in Q3 2020, initially to build resilience and open strategic autonomy for the rare earths and magnets value chain, before extending to other raw material areas (industry, Commission, investors, European Investment Bank, stakeholders, Member States, regions).

Action 2 – Develop sustainable financing criteria for the mining, extractive and processing sectors in Delegated Acts on Taxonomy by end 2021 (Platform on Sustainable Finance, Commission).

|

3.2.Circular use of resources, sustainable products and innovation

The European Green Deal’s Circular Economy Action Plan

aims to decouple growth from resource use through sustainable product design and mobilising the potential of secondary raw materials

. Moving towards a more circular economy could bring a net increase of 700 000 jobs in the EU, by 2030

. Circularity and recycling of raw materials from low-carbon technologies is an integral part of the transition to a climate-neutral economy. Increasing product life-time, and the use of secondary raw materials, through a robust and integrated EU market and retention of value of high-grade materials, will help to cover a growing share of the EU’s raw materials demand. For example, to foster recovery of materials from rapidly increasing amounts of batteries placed on the European market , the Commission will propose by October 2020 a new comprehensive regulation addressing, among other aspects, the end-life-phase, i.e. second life (re-use and re-purposing), collection rates, recycling efficiency and recovery of materials, recycled content and extended producer responsibility.

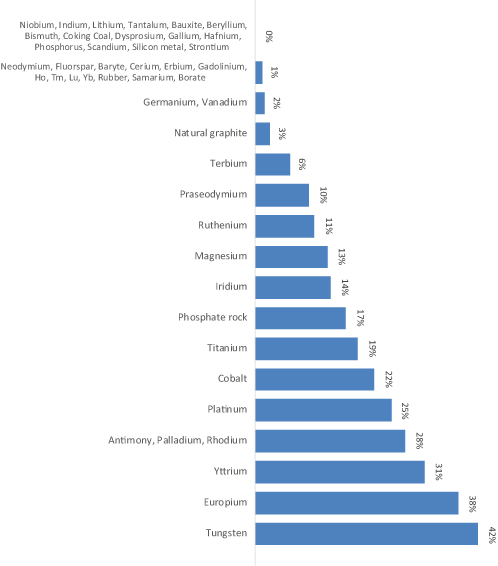

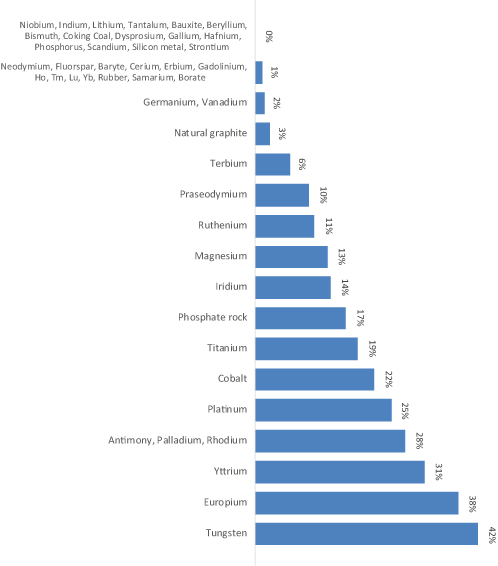

The EU is at the forefront of the circular economy and has already increased its use of secondary raw materials. For example, more than 50% of some metals such as iron, zinc, or platinum are recycled and they cover more than 25% of the EU’s consumption. For others, however, especially those needed in renewable energy technologies or high-tech applications such as rare earths, gallium, or indium, secondary production makes only a marginal contribution. This is a huge loss of potential value to the EU economy and a source of avoidable strain on the environment and climate.

Figure 2: Recycling’s contribution to meeting materials demand (Recycling Input Rate)

More research into waste reprocessing will help to avoid valuable materials ending up in landfill. Significant amounts of resources leave Europe in the form of wastes and scrap, which are potentially recyclable into secondary raw materials here. The extractive and processing industries must also become greener – reducing their planetary footprint, including greenhouse gas emissions.

We lack complete information on the amount of raw materials contained in products, in extractive waste or landfilled, i.e. potentially available for recovery or recycling. An assessment of the amount of materials in stock, i.e. contained in products that are in use, could shed light on when these would become available for recycling, considering the average life-time of products.

Replacing a critical raw material with a non-critical raw material that offers similar performance (substitution) is another way to alleviate critical raw materials dependency. Materials innovation; sustainable design and the development of alternative technologies requiring different materials can also contribute to mitigating supply risk.

|

Action 3- Launch critical raw materials research and innovation in 2021 on waste processing, advanced materials and substitution, using Horizon Europe, the European Regional Development Fund and national R&I programmes (Commission, Member States, regions, R&I Community);

Action 4 - Map the potential supply of secondary critical raw materials from EU stocks and wastes and identify viable recovery projects by 2022 (Commission, EIT Raw Materials).

|

3.3.Sourcing from the European Union

As global demand for critical raw material grows, primary raw materials will continue to play a key role. Mobilising Europe’s domestic potential better is an essential part of the EU becoming more resilient and developing open strategic autonomy.

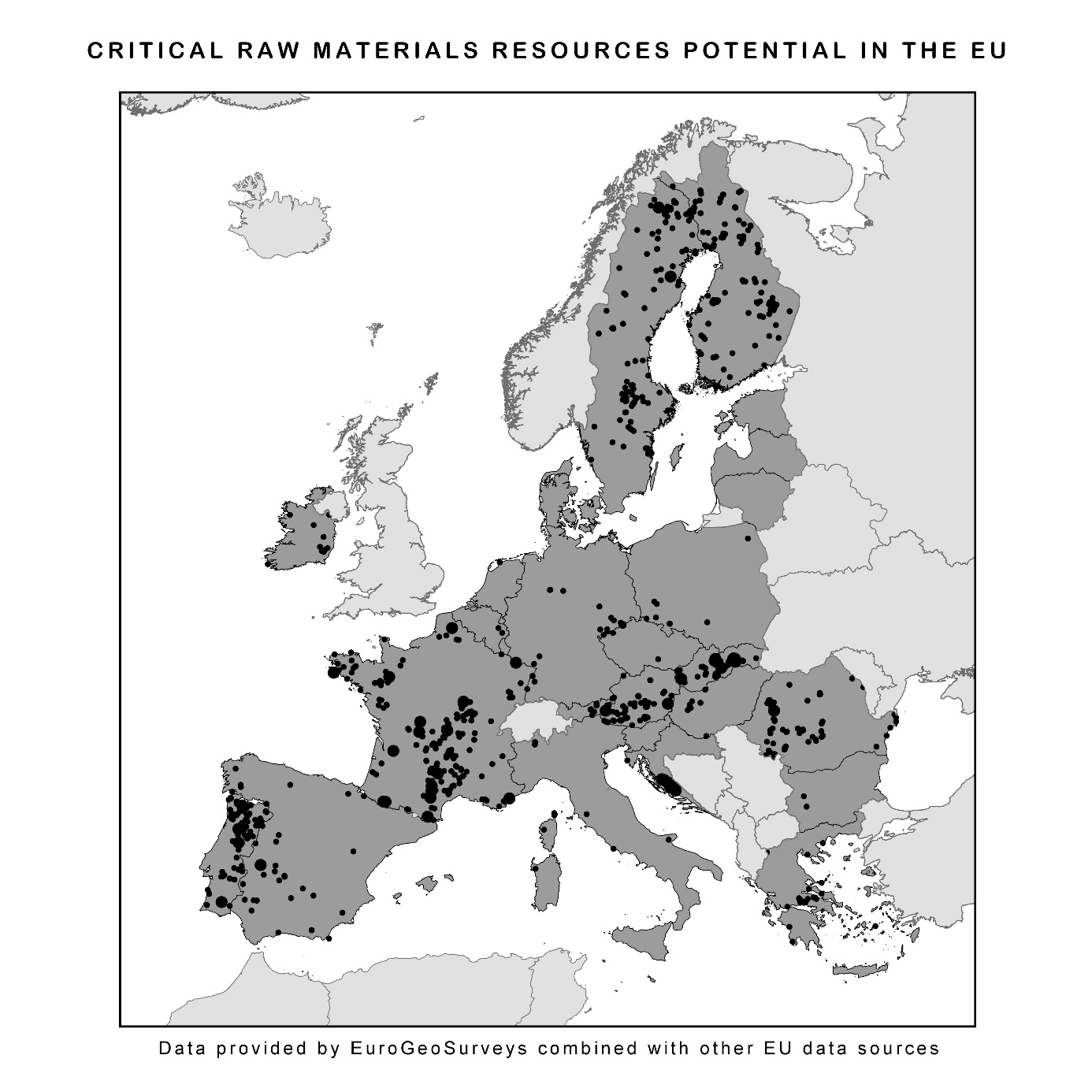

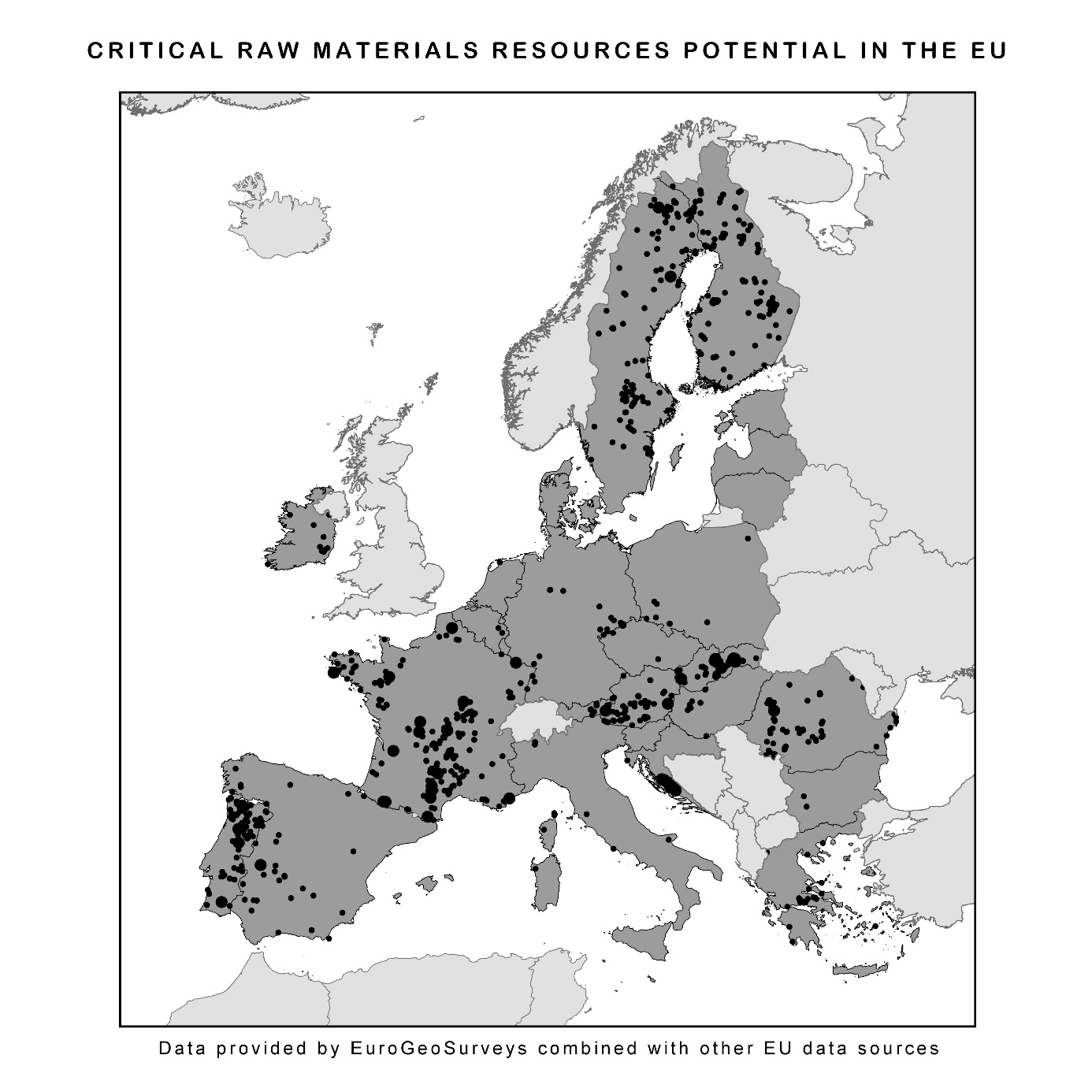

Europe has a long tradition of mining and extractive activities. It is well-endowed with aggregates and industrial minerals as well as certain base metals such as copper and zinc. It is less successful in developing projects to source critical raw materials, even though there is significant potential for these. See Figure 3. The reasons are multi-faceted: lack of investment in exploration and mining, diverse and lengthy national permitting procedures or low levels of public acceptance.

Figure 3: CRM deposits EU-27 (2020)

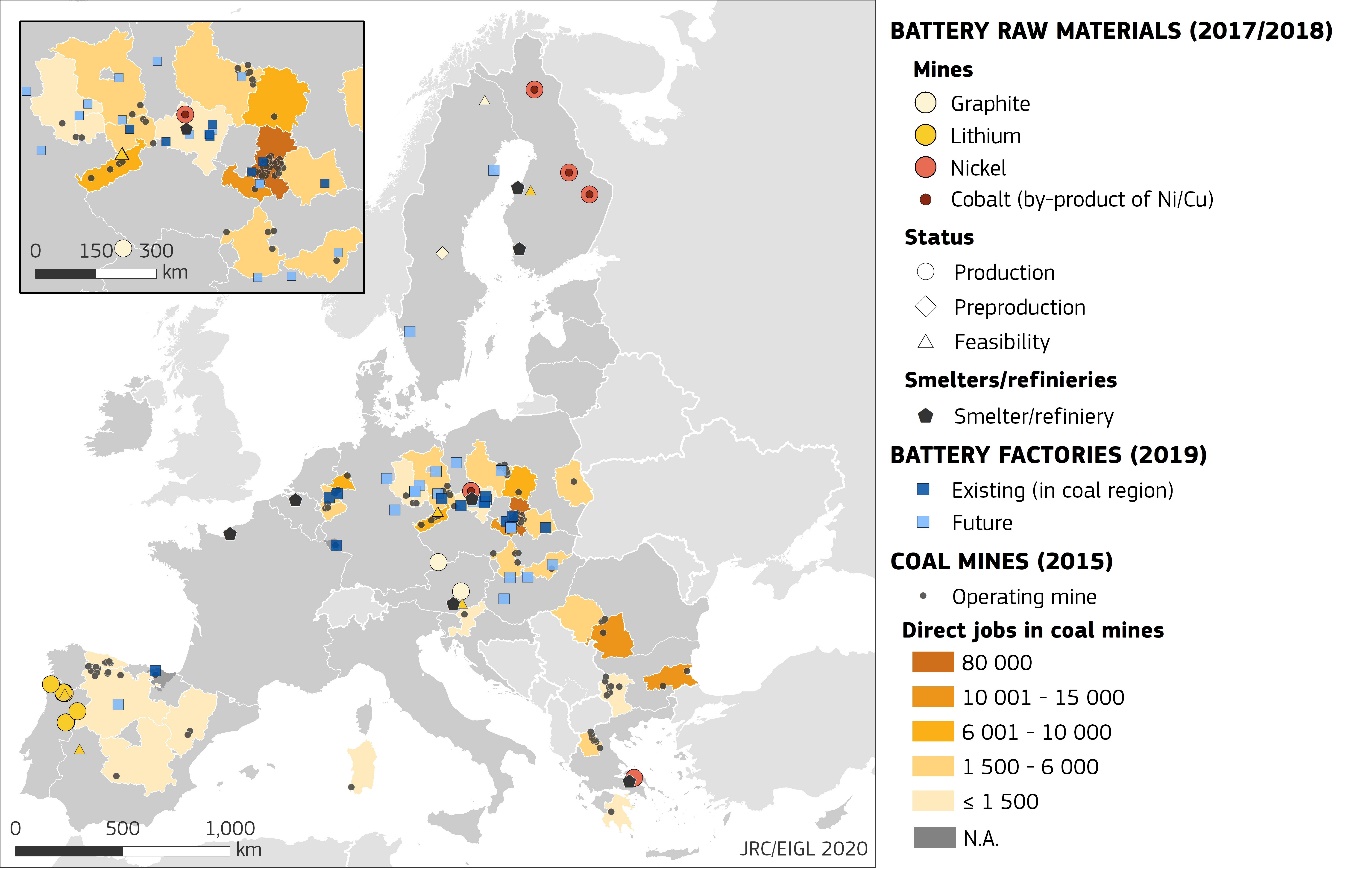

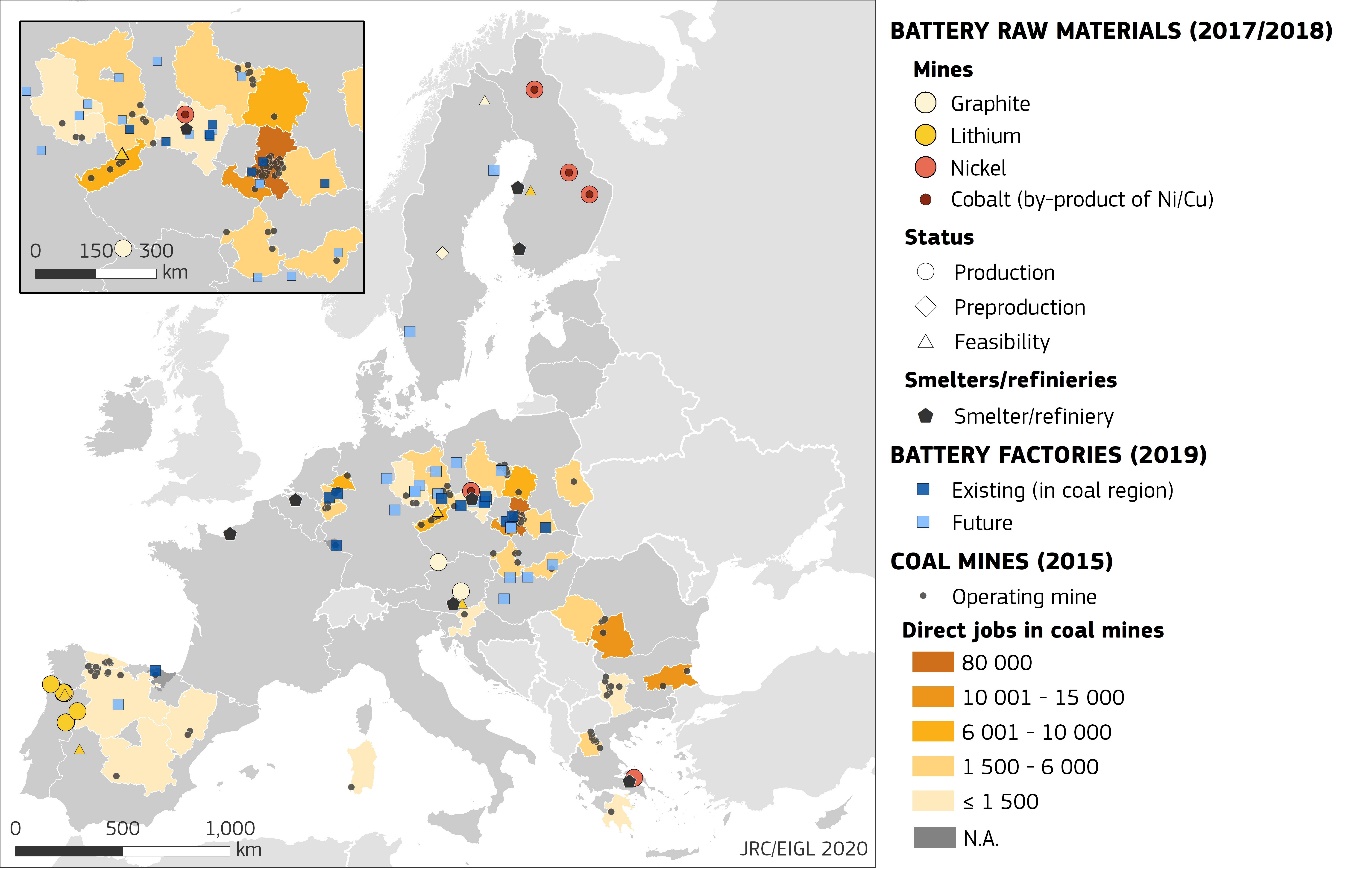

Looking at the geographical distribution of critical raw materials in Europe, the development of battery raw materials such as lithium, nickel, cobalt, graphite and manganese provides interesting opportunities. Companies in several Member States are already participating in the European Batteries Alliance, benefiting from private sector, EU and national funding, both for the exploitation of the raw materials and for their processing in Europe.

Figure 4 shows that many EU battery raw material resources lie in regions that are heavily dependent on coal or carbon-intensive industries and where battery factories are planned. Furthermore, many mining wastes are rich in critical raw materials

and could be revisited to create new economic activity on existing or former coal-mining sites while improving the environment.

Figure 4: Battery raw material mines, battery factories and coal mines

Source: Joint Research Centre

The Just Transition Mechanism will help to alleviate the socio-economic impact of the transition to climate neutrality in coal and carbon-intensive regions. It can support the economic diversification of regions including through circular economy investments. The sustainable infrastructure window under InvestEU could also support regional development of critical raw materials.

The development of territorial just transition plans provides an early opportunity for Member States to assess the potential of critical raw materials as one of the alternative business models and sources of regional employment. Many of the mining and engineering skills are transferable to the exploitation of metals and minerals, often in the same regions. The updated EU Skills Agenda could support this adaptation.

The EU and its Member States already have a good legislative framework in place to ensure that mining takes place under environmentally and socially sound conditions.

However, it is very difficult to bring new critical raw material projects to the operational stage quickly. This is partly due to the inherent risk and cost of new projects, but is also attributable to the lack of incentives and financing for exploration, the length of national permitting procedures and the lack of public acceptance for mining in Europe. Under the Better Regulation agenda, the Commission is currently working with key stakeholders to map out obstacles to major infrastructure projects with a view to accelerate and facilitate procedures in the Member States, as highlighted by the 21 July 2020 European Council Conclusions, while maintaining high standards.

Innovative technological solutions are transforming the mining and processing of critical raw materials. The sector is already using automation and digitalisation. Remote sensing using Europe’s earth-observation Copernicus Programme can become a powerful tool to identify new critical raw material sites, monitor the environmental performance of mines during their operating life and after closure.

|

Action 5 - Identify mining and processing projects and investment needs and related financing opportunities for critical raw materials in the EU that can be operational by 2025, with priority for coal-mining regions (Commission, Member States, regions, stakeholders);

Action 6 – Develop expertise and skills in mining, extraction and processing technologies, as part of a balanced transition strategy in regions in transition from 2022 onwards (Commission, industry, trade unions, Member States and regions);

Action 7 - Deploy Earth-observation programmes and remote sensing for resource exploration, operations and post-closure environmental management (Commission, industry);

Action 8 – Develop Horizon Europe R&I projects on processes for exploitation and processing of critical raw materials to reduce environmental impacts starting in 2021 (Commission, R&I community).

|

3.4.Diversified sourcing from third countries

Due to the geological limitations of the EU, future demand of primary critical raw materials will continue to be largely met by imports also in the medium to long term. The EU’s open strategic autonomy in these sectors therefore needs to continue to be anchored in well-diversified and undistorted access to global markets for raw materials.

Resilience for critical raw materials supply will also be achieved by reinforcing use of EU trade policy tools (including Free Trade Agreements and enhanced enforcement efforts) and work with international organisations to ensure undistorted trade and investment in raw materials in a manner that supports the EU’s commercial interests. The EU will also continue to be resolute in addressing non-respect of international obligations by third countries, in line with its commitment to enhance enforcement activities in the area of trade through the new Chief Trade Enforcement Officer (CTEO). The EU is also currently negotiating Free Trade Agreements with a number of important countries from a raw materials perspective. There will be potential for levelling the playing field further to allow European industries to compete on an equal footing with third country companies to engage directly in sustainable and responsibly-sourced raw materials. Energy and economic diplomacy with third countries is also important to reinforce the resilience of critical supply chains for the clean energy transition and energy security.

Shifting EU import payments for critical raw materials from other international currencies to the euro would have some advantages such as reducing price volatility, and making EU importers and third-country exporters less dependent on US dollar funding markets.

The Commission cooperates with partners on critical raw materials and sustainability in a range of international fora. These include the annual EU-US-Japan Trilateral on Critical Raw Materials (supply risks, trade barriers, innovation and international standards), the Organisation for Economic Cooperation and Development (conflict minerals, guidance on raw materials, responsible sourcing), the United Nations (global outlook, environmental pressures, resource management, mineral governance), the WTO (market access, technical barriers, export restrictions) and the G20 (resource efficiency). It also has bilateral raw material dialogues with a range of countries, including China.

The EU will need to engage in strategic partnerships with resource-rich third countries, making use of all external policy instruments and respecting its international obligations. There is large untapped potential for building sustainable and responsible strategic partnerships with resource-rich countries. These range from highly developed mining countries like Canada and Australia, several developing countries in Africa and Latin America and countries close to the EU like Norway, Ukraine, enlargement countries and the Western Balkans. It is important to integrate the Western Balkans into EU supply chains

. Serbia, for example has borates, while Albania has platinum deposits. Rather than trying to develop all these partnerships at once, the Commission envisages, before launching pilot partnership projects in 2021, to discuss priorities with Member States and industry, including in the countries concerned as they have local expertise and a network of Member State embassies.

Such strategic partnerships covering extraction, processing and refining are particularly relevant for resource-rich developing countries and regions such as Africa. The EU can help our partner countries’ to develop their mineral resources sustainably through supporting improved local governance and dissemination of responsible mining practices, creating in turn value added in the mining sector and drivers for economic and social development.

Increased engagement with strategic partners to secure critical raw materials will need to go hand in hand with responsible sourcing. High supply concentration in countries with low standards of governance

not only poses a security of supply risk, but may also exacerbate environmental and social problems, such as child labour. Conflicts arising from or aggravated by access to resources are also a recurrent source of international tension.

Responsible sourcing and due diligence are growing in importance throughout the raw materials value chain. The EU Regulation on Conflict Minerals

, covering tin, gold, and the critical raw materials tantalum and tungsten, applies to EU importers as of 1 January 2021 and addresses such concerns. The European Partnership on Responsible Minerals

helps mines to comply with the EU Regulation and OECD due diligence guidance. The forthcoming proposal for a Batteries Regulation will address the responsible sourcing of battery raw materials and the Commission is considering making a possible horizontal regulatory proposal on due diligence.

The use of EU external financial instruments, such as development cooperation, neighbourhood funding and the Partnership Instrument Policy Support Facility will help to leverage private investment, thus ensuring that mutual benefits are achieved and that EU companies can participate on a level playing field in projects taking place in third countries.

|

Action 9 – Develop strategic international partnerships and associated funding to secure a diversified and sustainable supply of critical raw materials, including through undistorted trade and investment conditions, starting with pilot partnerships with Canada, interested countries in Africa and the EU’s neighbourhood in 2021 (Commission, Member States, industry and third country counterparts);

Action 10 - Promote responsible mining practices for critical raw materials through the EU regulatory framework (proposals in 2020-2021) and relevant international cooperation

(Commission, Member States, industry, civil society organisations);

|

4. Conclusion

The stakes are high. The EU’s success in transforming and modernising its economy depends on securing in a sustainable way the primary and secondary raw materials needed to scale up clean and digital technologies in all of the EU’s industrial ecosystems.

The EU must act to become more resilient in coping with possible future shocks and in leading the twin green and digital transformations. One of the lessons of the COVID-19 crisis is the need to reduce dependency and strengthen diversity and security of supply. Enhancing open strategic autonomy will be a long-term benefit to the EU. The EU institutions, national and sub-national authorities as well as companies should become much more agile and effective in securing a sustainable supply of critical raw materials.

This Communication highlights related priorities and recommends key areas of work for the EU to reinforce its strategic approach towards more resilient raw materials value chains.

To that end, the Commission will work in close partnership with other EU institutions, the European Investment Bank, Member States, regions, the industry and other key stakeholders. It will monitor progress in implementing the above strategic priorities and actions, explore any additional support measures needed and make relevant recommendations by 2022 at the latest.

Annex 1: List of Critical Raw Materials

|

Raw materials

|

Stage

|

Main global

producers

|

Main EU sourcing

countries

|

Import reliance

|

EoL-RIR

|

Selected Uses

|

|

Antimony

|

Extraction

|

China (74%)

Tajikistan (8%)

Russia (4%)

|

Turkey (62%)

Bolivia (20%)

Guatemala (7%)

|

100%

|

28%

|

·Flame retardants

·Defence applications

·Lead-acid batteries

|

|

Baryte

|

Extraction

|

China (38%)

India (12%)

Morocco (10%)

|

China (38%)

Morocco (28%)

Other EU (15%)

Germany (10%)

Norway (1%)

|

70%

|

1%

|

·Medical applications

·Radiation protection

·Chemical applications

|

|

Bauxite

|

Extraction

|

Australia (28%)

China (20%)

Brazil (13%)

|

Guinea (64%)

Greece (12%)

Brazil (10%)

France (1%)

|

87%

|

0%

|

·Aluminium production

|

|

Beryllium

|

Extraction

|

United States (88%)

China (8%)

Madagascar (2%)

|

n/a

|

n/a

|

0%

|

·Electronic and

Communications Equipment

·automotive, aero-space and defence

components

|

|

Bismuth

|

Processing

|

China (85%)

Lao Pdr (7%)

Mexico (4%)

|

China (93%)

|

100%

|

0%

|

·Pharmaceutical and animal feed industries

·Medical applications

·Low-melting point alloys

|

|

Borate

|

Extraction

|

Turkey (42%)

United States (24%)

Chile (11%)

|

Turkey (98%)

|

100%

|

1%

|

·High performance glass

·Fertilisers

·Permanent magnets

|

|

Cobalt

|

Extraction

|

Congo DR (59%)

China (7%)

Canada (5%)

|

Congo DR (68%)

Finland (14%)

French Guiana (5%)

|

86%

|

22%

|

·Batteries

·Super alloys

·Catalysts

·Magnets

|

|

Coking coal

|

Extraction

|

China (55%)

Australia (16%)

Russia (7%)

|

Australia (24%)

Poland (23%)

United States (21%)

Czechia (8%)

Germany (8%)

|

62%

|

0%

|

·Coke for steel

·Carbon fibres

·Battery electrodes

|

|

Fluorspar

|

Extraction

|

China (65%)

Mexico (15%)

Mongolia (5%)

|

Mexico (25%)

Spain (14%)

South Africa (12%)

Bulgaria (10%)

Germany (6%)

|

66%

|

1%

|

·Steel and iron making

·Refrigeration and

Air-conditioning

·Aluminium making and other metallurgy

|

|

Gallium

|

Processing

|

China (80%)

Germany (8%)

Ukraine (5%)

|

Germany (35%)

UK (28%)

China (27%)

Hungary (2%)

|

31%

|

0%

|

·Semiconductors

·Photovoltaic cells

|

|

Germanium

|

Processing

|

China (80%)

Finland (10%)

Russia (5%)

|

Finland (51%)

China (17%)

UK (11%)

|

31%

|

2%

|

·Optical fibres and Infrared optics

·Satellite solar cells

·Polymerisation catalysts

|

|

Hafnium

|

Processing

|

France (49%)

United States (44%)

Russia (3%)

|

France (84%)

United States (5%)

UK (4%)

|

0%

|

0%

|

·Super alloys

·Nuclear control rods

·Refractory ceramics

|

|

Indium

|

Processing

|

China (48%)

Korea, Rep. (21%)

Japan (8%)

|

France (28%)

Belgium (23%)

UK (12%)

Germany (10%)

Italy (5%)

|

0%

|

0%

|

·Flat panel displays

·Photovoltaic cells and photonics

·Solders

|

|

Lithium

|

Processing

|

Chile (44%)

China (39%)

Argentina (13%)

|

Chile (78%)

United States (8%)

Russia (4%)

|

100%

|

0%

|

·Batteries

·Glass and ceramics

·Steel and aluminium metallurgy

|

|

Magnesium

|

Processing

|

China (89%)

United States (4%)

|

China (93%)

|

100%

|

13%

|

·Lightweight alloys for automotive, electronics, packaging or

construction

·Desulphurisation agent in steelmaking

|

|

Natural Graphite

|

Extraction

|

China (69%)

India (12%)

Brazil (8%)

|

China (47%)

Brazil (12%)

Norway (8%)

Romania (2%)

|

98%

|

3%

|

·Batteries

·Refractories for steelmaking

|

|

Natural Rubber

|

Extraction

|

Thailand (33%)

Indonesia (24%)

Vietnam (7%)

|

Indonesia (31%)

Thailand (18%)

Malaysia (16%)

|

100%

|

1%

|

·Tires

·Rubber components

for machinery and household goods

|

|

Niobium

|

Processing

|

Brazil (92%)

Canada (8%)

|

Brazil (85%)

Canada (13%)

|

100%

|

0%

|

·High-strength steel

and super alloys for

transportation and

infrastructure

·High-tech applications (capacitors, superconducting magnets, etc.)

|

|

Phosphate rock

|

Extraction

|

China (48%)

Morocco (11%)

United States (10%)

|

Morocco (24%)

Russia (20%)

Finland (16%)

|

84%

|

17%

|

·Mineral fertilizer

·Phosphorous

compounds

|

|

Phosphorus

|

Processing

|

China (74%)

Kazakhstan (9%)

Vietnam (9%)

|

Kazakhstan (71%)

Vietnam (18%)

China (9%)

|

100%

|

0%

|

·Chemical applications

·Defence applications

|

|

Scandium

|

Processing

|

China (66%)

Russia (26%)

Ukraine (7%)

|

UK (98%)

Russia (1%)

|

100%

|

0%

|

·Solid Oxide Fuel Cells

·Lightweight alloys

|

|

Silicon metal

|

Processing

|

China (66%)

United States (8%)

Norway (6%)

France (4%)

|

Norway (30%)

France (20%)

China (11%)

Germany (6%)

Spain (6%)

|

63%

|

0%

|

·Semiconductors

·Photovoltaics

·Electronic components

·Silicones

|

|

Strontium

|

Extraction

|

Spain (31%)

Iran, Islamic Rep. (30%)

China (19%)

|

Spain (100%)

|

0%

|

0%

|

·Ceramic magnets

·Aluminium alloys

·Medical applications

·Pyrotechnics

|

|

Tantalum

|

Extraction

|

Congo, DR (33%)

Rwanda (28%)

Brazil (9%)

|

Congo, DR (36%)

Rwanda (30%)

Brazil (13%)

|

99%

|

0%

|

·Capacitors for electronic devices

·Super alloys

|

|

Titanium

|

Processing

|

China (45%)

Russia (22%)

Japan (22%)

|

n/a

|

100%

|

19%

|

·Lightweight high-strength alloys for

e.g. aeronautics, space and defence

·Medical applications

|

|

Tungsten

|

Processing

|

China (69%)

Vietnam (7%)

United States (6%)

Austria (1%)

Germany (1%)

|

n/a

|

n/a

|

42%

|

·Alloys e.g. for aeronautics, space, defence, electrical technology

·Mill, cutting and mining tools

|

|

Vanadium

|

Processing

|

China (55%)

South Africa (22%)

Russia (19%)

|

n/a

|

n/a

|

2%

|

·High-strength-low-alloys for e.g. aeronautics, space, nuclear reactors

·Chemical catalysts

|

|

Platinum Group

Metals

|

Processing

|

South Africa (84%)

- iridium, platinum, rhodium, ruthenium

Russia (40%)

- palladium

|

n/a

|

100%

|

21%

|

·Chemical and

automotive catalysts

·Fuel Cells

·Electronic applications

|

|

Heavy Rare Earth

Elements

|

Processing

|

China (86%)

Australia (6%)

United States (2%)

|

China (98%)

Other non-EU (1%)

UK (1%)

|

100%

|

8%

|

·Permanent Magnets for electric motors and electricity generators

·Lighting Phosphors

·Catalysts

·Batteries

·Glass and ceramics

|

|

Light Rare Earth

Elements

|

Processing

|

China (86%)

Australia (6%)

United States (2%)

|

China (99%)

UK (1%)

|

100%

|

3%

|

|

Annex 2: Relevance of Critical Raw Materials for industrial ecosystems

|

|

Aerospace/ defence

|

Textiles

|

Electronics

|

Mobility/ Automotive

|

Energy-intensive industries

|

Renewable energy

|

Agri-food

|

Health

|

Digital

|

Construction

|

Retail

|

Proximity/ social economy

|

Tourism

|

Creative/ cultural industries

|

|

Antimony

|

✓

|

✓

|

|

✓

|

|

|

|

|

|

✓

|

|

|

|

|

|

Baryte

|

|

|

|

✓

|

✓

|

|

|

✓

|

|

✓

|

|

|

|

|

|

Bauxite

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

|

|

|

|

|

Beryllium

|

✓

|

|

✓

|

✓

|

|

✓

|

|

|

✓

|

|

|

|

|

|

|

Bismuth

|

✓

|

|

✓

|

|

✓

|

|

|

✓

|

✓

|

✓

|

|

|

|

|

|

Borate

|

✓

|

|

✓

|

✓

|

✓

|

✓

|

✓

|

|

✓

|

✓

|

|

|

|

|

|

Cobalt

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

|

|

✓

|

|

|

|

|

|

|

Coking coal

|

|

|

|

✓

|

✓

|

✓

|

|

|

|

|

|

|

|

|

|

Fluorspar

|

|

|

|

|

✓

|

|

✓

|

|

|

|

✓

|

|

|

|

|

Gallium

|

✓

|

|

✓

|

✓

|

|

✓

|

|

|

✓

|

✓

|

|

|

|

|

|

Germanium

|

✓

|

|

✓

|

|

✓

|

✓

|

|

|

|

|

|

|

|

|

|

Hafnium

|

✓

|

|

✓

|

|

✓

|

✓

|

|

|

✓

|

|

|

|

|

|

|

Indium

|

✓

|

|

✓

|

|

|

✓

|

|

|

✓

|

|

|

|

|

|

|

Lithium

|

✓

|

|

✓

|

✓

|

✓

|

✓

|

|

✓

|

✓

|

|

|

|

|

|

|

Magnesium

|

✓

|

|

✓

|

✓

|

✓

|

|

|

|

✓

|

✓

|

|

|

|

|

|

Natural graphite

|

✓

|

|

✓

|

✓

|

✓

|

✓

|

|

|

✓

|

✓

|

|

|

|

|

|

Natural Rubber

|

✓

|

✓

|

|

✓

|

|

|

|

✓

|

|

|

|

|

|

|

|

Niobium

|

✓

|

|

✓

|

✓

|

✓

|

|

|

✓

|

|

✓

|

|

|

|

|

|

Phosphate rock

|

|

|

|

|

✓

|

|

✓

|

|

|

|

|

|

|

|

|

Phosphorus

|

✓

|

|

|

|

✓

|

|

✓

|

|

|

|

|

|

|

|

|

Scandium

|

✓

|

|

|

✓

|

|

✓

|

|

|

|

|

|

|

|

|

|

Silicon metal

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

|

✓

|

|

✓

|

|

|

|

|

|

Strontium

|

✓

|

|

✓

|

|

✓

|

|

|

✓

|

|

✓

|

|

|

|

|

|

Tantalum

|

✓

|

|

✓

|

|

✓

|

✓

|

|

|

✓

|

|

|

|

|

|

|

Titanium

|

✓

|

|

✓

|

✓

|

✓

|

|

|

✓

|

|

✓

|

|

|

|

|

|

Tungsten

|

✓

|

|

✓

|

✓

|

✓

|

|

|

✓

|

|

|

|

|

|

|

|

Vanadium

|

✓

|

|

|

✓

|

✓

|

✓

|

|

✓

|

|

✓

|

|

|

|

|

|

PGM

|

✓

|

|

✓

|

✓

|

✓

|

✓

|

|

✓

|

|

|

|

|

|

|

|

HREE

|

✓

|

|

✓

|

✓

|

✓

|

✓

|

|

✓

|

|

✓

|

|

|

|

|

|

LREE

|

✓

|

|

✓

|

✓

|

✓

|

✓

|

|

✓

|

|

✓

|

|

|

|

|

EUROPEAN COMMISSION

EUROPEAN COMMISSION